(Bloomberg) — The Bitcoin rally sparked by US President-elect Donald Trump’s election victory in early November is stalling as 2024 draws to a close. Most Read from Bloomberg

- NYC’s Subway Violence Deters Drive to Bring Workers Back to Office

- Can American Drivers Learn to Love Roundabouts?

- Don’t Shrink the Bus

- Is This Weird Dome the Future of Watching Sports?

- NYC Congestion Pricing Takes Effect After Years of Delays

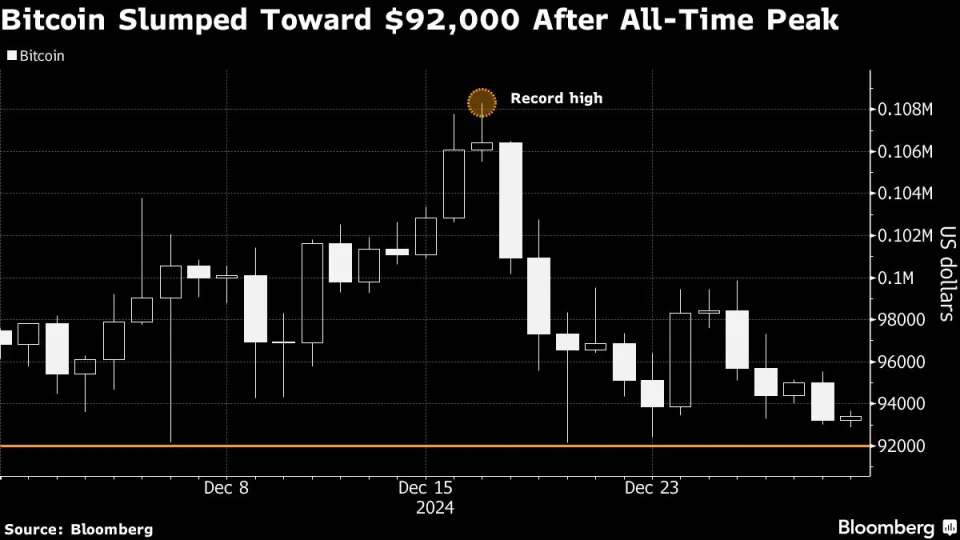

As of 2:55 p.m. on Tuesday in New York, Bitcoin’s price was hovering around $94,000, down about $14,000 from its peak of mid-December. Smaller cryptocurrencies like Ether and meme coin Dogecoin also faced challenges in gaining traction during the day.

Trump’s advocacy for crypto-friendly regulations and his support for a potential national Bitcoin reserve have been instrumental in propelling digital assets higher. However, scaled-back expectations regarding Federal Reserve interest-rate cuts have tempered speculative enthusiasm.

The rollout of clearer US cryptocurrency regulations is expected to become more defined after Trump takes office on January 20. This stance contrasts sharply with that of President Joe Biden’s administration, which has actively cracked down on the sector amid ongoing scandals.

Chris Weston, head of research at Pepperstone Group, noted that "the momentum has waned" in Bitcoin’s movement post-election. Part of this decline is attributed to outflows from exchange-traded funds (ETFs) targeting Bitcoin. According to Bloomberg data, a group of dozen US-based ETFs saw a net outflow of nearly $1.8 billion since December 19.

Meanwhile, cryptocurrency software company MicroStrategy has been actively accumulating Bitcoin in recent weeks. traders are eagerly awaiting news on whether the company will continue its pattern of announcing Bitcoin purchases every Monday. With assets exceeding $40 billion, MicroStrategy’s position underscores the growing interest in digital currencies despite broader market fluctuations.

This year alone, Bitcoin has surged roughly 120%, outpacing traditional investments such as global stocks and gold. The cryptocurrency also more than doubled in value during 2023, riding a wave of recovery from a deep bear market.

Most Read from Bloomberg Businessweek

- The US’s Worst Fears of Chinese Hacking Are on Display in Guam

- Elon Musk Is Not Having a Happy New Year

- Why Everyone’s Obsessed With Meat Sticks and Cottage Cheese

- Zyn’s Online Hype Risks Leading to the Nicotine Pouches’ Downfall

- What Will Elon Musk Do in 2025?

© 2024 Bloomberg L.P.