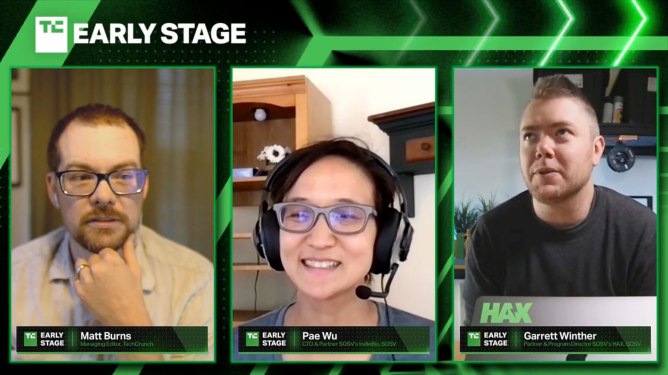

At the recent TechCrunch Early Stage: Marketing and Fundraising event, two experienced investors from SOSV shared their insights on the challenges of raising capital for deep tech startups. Pae Wu and Garrett Winther, partners at SOSV, discussed three key points that are essential for deep tech startups to overcome the hurdles in fundraising.

Finding the Right Investor

The first point highlighted by Wu and Winther is the importance of finding the right investor for your startup. This may seem like a straightforward concept, but it’s especially crucial for deep tech companies that often require longer periods to show returns on investment. When building a deep tech startup, it’s essential to think about founder-investor fit.

Founder-Investor Fit: A Venn Diagram

According to Wu and Winther, the founder-investor fit can be represented as a Venn diagram between founders who have a "near maniacal devotion" to solving core systemic problems and investors who thrive on unique risk profiles. Deep tech startups often come with technical risks that are challenging for investors to understand.

Technical Risk in Deep Tech

Wu explained the concept of technical risk, stating that it’s not just about breaking laws of physics but also about understanding the underlying technology. With deep tech, investors need to be willing to take on both technical and business risks.

Set Obtainable Goals

The second point emphasized by Wu and Winther is the importance of setting obtainable goals that lead to the desired outcome. Breakthrough technology rarely comes from sudden breakthroughs; instead, it’s often the result of a series of smaller innovations that build upon each other.

Obtaining Stepping Stones

Wu highlighted the need for founders to focus on obtaining stepping stones rather than trying to achieve everything at once. This approach enables startups to make steady progress and demonstrate their capabilities to investors.

Founders’ Passion and Persistence

Winther emphasized the importance of passion and persistence among founders. He stated that deep tech startups require a unique combination of technical expertise, business acumen, and entrepreneurial spirit.

SOSV’s Approach to Investing in Deep Tech

As a venture capital firm focused on supporting early-stage startups, SOSV’s approach is centered around investing in companies with significant potential for growth. The firm looks for founders who are passionate about their projects and have the expertise to execute them.

Conclusion

Raising capital for deep tech startups can be challenging due to the unique risks involved. However, by finding the right investor, setting obtainable goals, and demonstrating passion and persistence, startups can increase their chances of success in fundraising efforts. As the technology landscape continues to evolve, it’s essential for entrepreneurs and investors alike to understand the complexities of deep tech innovation.

Related Articles

- How to Prepare Your Deep Tech Startup for Fundraising

- A comprehensive guide on preparing your deep tech startup for fundraising

- The Importance of Founder-Investor Fit in Deep Tech Investing

- An in-depth look at the founder-investor fit and its significance in deep tech investing

Recommended Reading

- Deep Tech Investing: Trends, Opportunities, and Challenges

- A report on the current state of deep tech investing, including trends, opportunities, and challenges

- The Future of Deep Tech: Emerging Trends and Innovations

Resources

- SOSV’s website: Learn more about SOSV’s investment approach and portfolio companies

- Deep Tech Investing community: Join a community of investors and entrepreneurs focused on deep tech innovation